Book Value Vs Market Value: What are the Key Differences?

Net book value represents the original cost of an asset minus accumulated depreciation and impairment losses. In contrast, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. While par value may seem like a relic of the past, it plays a significant role in the financial and legal aspects of stock transactions.

Key Differences

Stocks can be overbought or oversold according to technical analysis, and also be subject to economic volatility like manias or panics. If book value is higher than market value, it may suggest the stock is undervalued — that the market hasn’t fully recognized the company’s intrinsic worth. Book value and market value offer two very different ways of looking at a company — one is grounded in a business’s balance sheet, and the other serves as a broad representation of market sentiment.

Market Value Vs Book Value: Key Differences And Uses

Due to several factors, one of which includes fluctuations, the accuracy of both figures also differs. A company’s book value usually stays accurate for a long time unless significant changes occur in its assets or liabilities. Therefore, this figure will not often be an accurate representation of a company’s value. The higher the value of a company’s total assets is, the more its book value will be. Utilized by investors, analysts, and traders for investment decisions, reflecting market expectations for growth and performance.

- It is calculated by subtracting accumulated depreciation from the original cost of an asset.

- It is dynamic, constantly fluctuating based on supply and demand, investor sentiment, and market conditions.

- Net book value represents the original cost of an asset minus accumulated depreciation and impairment losses.

- In conclusion, book value and market value often differ significantly in various real-world examples.

- Book value, however, is derived from a company’s net assets, which is the amount that shareholders would theoretically receive if a company was liquidated.

Key differences: Book value vs. market value

One is not superior to the other when it comes to valuation – the real advantage comes in comparison. When set against each other, they help investors to determine if stocks are overpriced or underpriced. Market value represents the perception of the company’s valuation, which doesn’t always reflect the whole picture.

When evaluating companies, the book value can be a significant indicator of internal resources. By doing so, investors can how are book value and market value different determine whether a company’s stocks are undervalued or overvalued. The P/B ratio helps investors assess how a company’s market valuation compares to the value of its net assets. Values under 1 typically indicate an undervalued stock — the operative word here being typically.

- These two metrics offer different perspectives on a company’s worth, each with its own set of implications.

- By doing so, investors can determine whether a company’s stocks are undervalued or overvalued.

- Recognizing these influences enables investors to construct balanced investment strategies.

- Investors rely on these calculations to gauge financial health and market perception accurately.

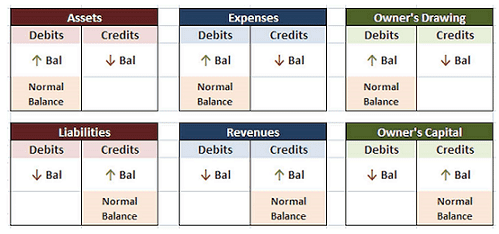

- Balance Sheet items are shown in book value as per Generally Accepted Accounting Principles (GAAP).

Enter the Price-to-Book (P/B) Ratio

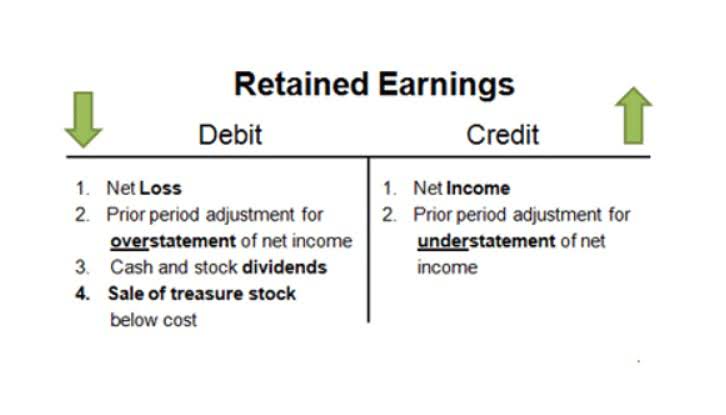

On the other hand, this concept also refers to the value of a company’s Shareholder’s Equity as measured by accounting records. One is an objective approach that encompasses balance sheets and financial statements — a company’s books. The other is a more subjective approach, which takes into account the sometimes irrational sentiments of the stock market. From the perspective of an auditor, market value provides a more realistic assessment of an asset’s worth at a given point in time, which can enhance the accuracy of financial statements.

From an accountant’s perspective, these two figures can tell different stories about an asset’s financial health. Fair value can provide a more dynamic and current view, often used in the context of fair value accounting and required by standards such as IFRS 13. On the other hand, net book value offers a more conservative and historical perspective, rooted in the original cost of the asset and its expected useful life. In conclusion, book value and market value often differ significantly in various real-world examples. These differences have important implications for investors, influencing their investment decisions, risk assessments, and long-term outlook. Understanding and analyzing these disparities can help investors make informed decisions and navigate the complexities of the financial markets.

Factors influencing value

While both terms relate to value measurements, they serve distinct purposes and are derived from different accounting principles. Book value, also known as net asset value, represents the value of a company’s assets minus its liabilities, as recorded on the balance sheet. It is a reflection of what shareholders’ equity would be if the company were liquidated at the values stated in the financial statements.

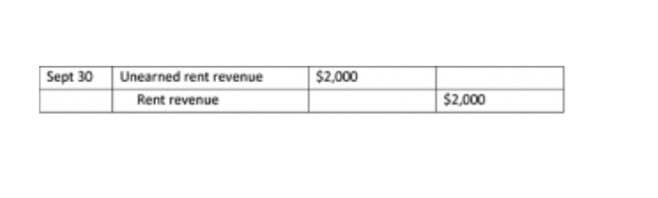

However, revaluation is allowed under International Financial Reporting Standards (IFRS). One case in which a business can recognize changes in the value of assets is for marketable securities classified as trading securities. A business is required to continually record holding gains and holding losses on these securities for as long as they are held. In this case, market value is the same as book value on the books of the reporting entity.

However, its market value of equity is $500 million, reflecting investor optimism about its innovative products and growth prospects. The significant difference between book value and market value highlights the importance of intangible assets, such as intellectual property and brand value, which are not captured in the book value. When it comes to evaluating the worth of a company or an asset, two commonly used metrics are book value and market value.

It indicates investors’ valuation of a company’s worth based on market perceptions, future growth potential, and economic conditions. By considering these points, accountants can appreciate the nuances between fair value and net book value, ensuring accurate financial reporting and informed decision-making. For example, a company might report a piece of land on its balance sheet at its net book value of $200,000, reflecting its historical cost. However, if the current market conditions indicate that the land could sell for $300,000, the fair value would provide a different perspective on the asset’s potential profitability if sold. Shareholder’s equity is a reflection of a company’s net worth, or book value, as determined by the difference between total assets and total liabilities. It represents the amount that would be returned to shareholders if all the company’s assets were liquidated and all its debts repaid.